October 2021

In a paper that uses new data and methods to measure top wealth in the United States, Matthew Smith (Treasury) Owen Zidar (Princeton), and Eric Zwick (Chicago Booth) provide a detailed picture of how America’s ultra-rich build wealth and the pace at which inequality has grown.

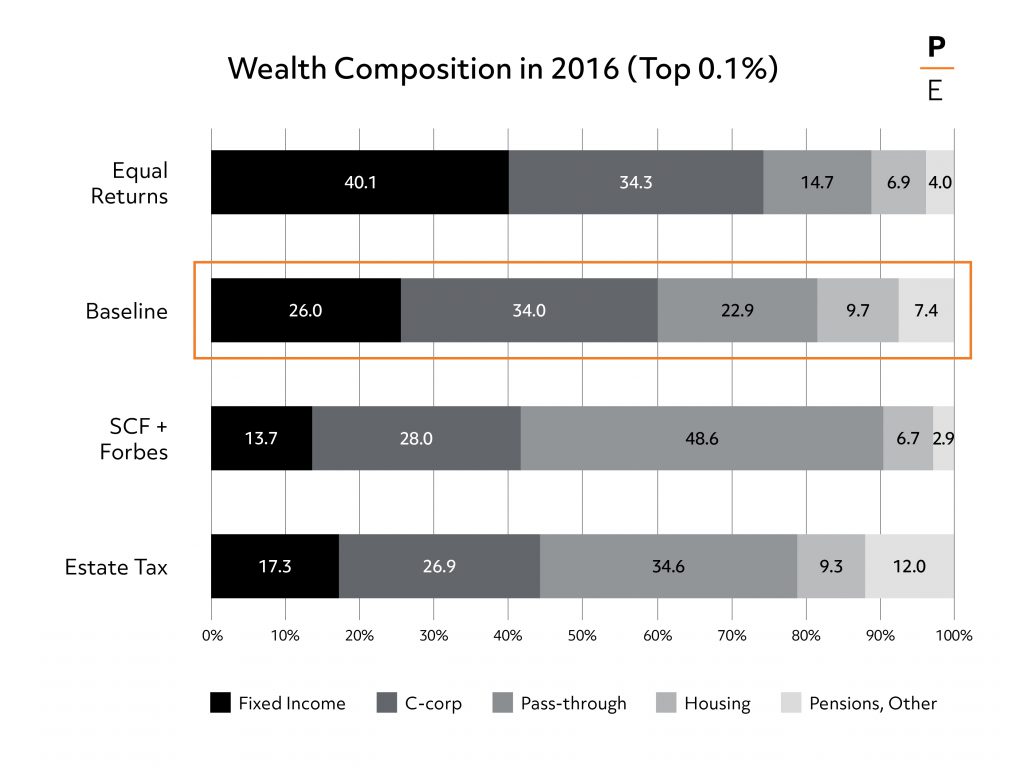

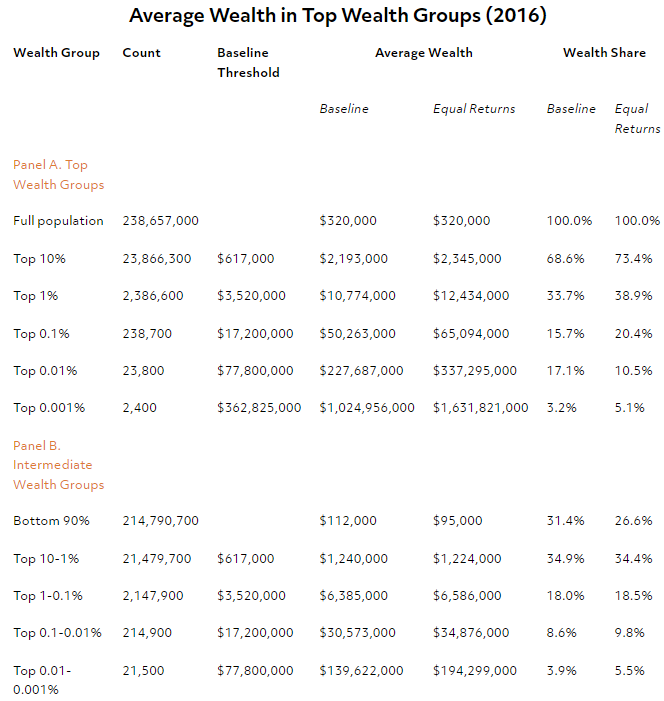

Their findings show that wealth is very concentrated: The top 1% holds nearly as much wealth as the bottom 90% and the “P90-99” class. However, inequality has grown less dramatically than other widely-cited estimates suggest and wealth is less concentrated among the very rich (the 0.1%) than many believe. The authors find that wealth held by the top 0.1%—who averaged $50 million in wealth in 2016—has increased from 13.4% to 15.7% from 2001 to 2016. Past estimates place the share of wealth held by the top 0.1% at 20.4%.

Average Wealth in Top Wealth Groups (2016) |

||||||

| Wealth Group | Count | Baseline Threshold | Average Wealth | Wealth Share | ||

| Baseline | Equal Returns | Baseline | Equal Returns | |||

| Panel A. Top Wealth Groups | ||||||

| Full population | 238,657,000 | $320,000 | $320,000 | 100.0% | 100.0% | |

| Top 10% | 23,866,300 | $617,000 | $2,193,000 | $2,345,000 | 68.6% | 73.4% |

| Top 1% | 2,386,600 | $3,520,000 | $10,774,000 | $12,434,000 | 33.7% | 38.9% |

| Top 0.1% | 238,700 | $17,200,000 | $50,263,000 | $65,094,000 | 15.7% | 20.4% |

| Top 0.01% | 23,800 | $77,800,000 | $227,687,000 | $337,295,000 | 17.1% | 10.5% |

| Top 0.001% | 2,400 | $362,825,000 | $1,024,956,000 | $1,631,821,000 | 3.2% | 5.1% |

| Panel B. Intermediate Wealth Groups | ||||||

| Bottom 90% | 214,790,700 | $112,000 | $95,000 | 31.4% | 26.6% | |

| Top 10-1% | 21,479,700 | $617,000 | $1,240,000 | $1,224,000 | 34.9% | 34.4% |

| Top 1-0.1% | 2,147,900 | $3,520,000 | $6,385,000 | $6,586,000 | 18.0% | 18.5% |

| Top 0.1-0.01% | 214,900 | $17,200,000 | $30,573,000 | $34,876,000 | 8.6% | 9.8% |

| Top 0.01-0.001% | 21,500 | $77,800,000 | $139,622,000 | $194,299,000 | 3.9% | 5.5% |

There is no single source of data on how much wealth the richest Americans have. To estimate it, the authors start with administrative income data they can observe and then make assumptions about how much wealth that income translates to. Their methodology shows the importance, for researchers adopting this “capitalization” approach, of understanding that the rich have much higher risk exposure and therefore earn higher returns on their investments. The interest rate on fixed income at the top is about 3 times higher than the average return.

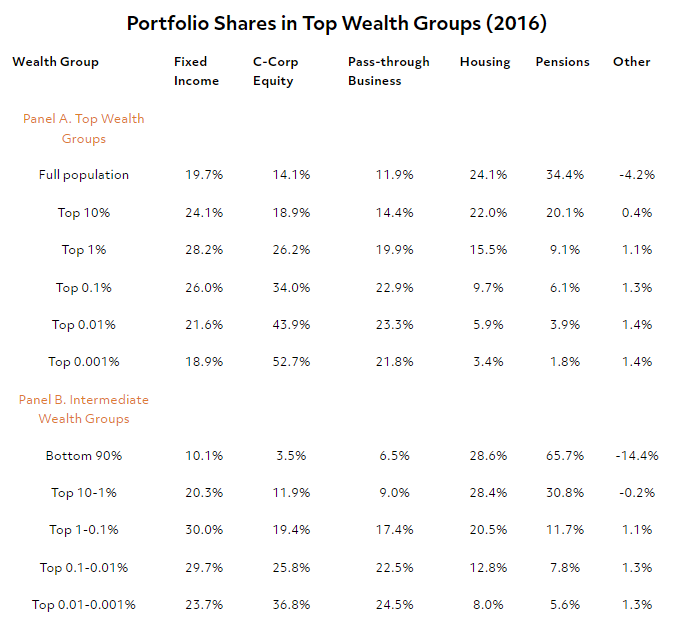

This work sheds new light on how the rich build wealth and what tax policies would most effectively raise revenue and curb the rise in inequality. In terms of the composition of wealth held by the top 1%, pass-through business income and C-corporation business equity play a much larger role than fixed income from sources like bonds. Pass-through business income has been undercounted in the past because prior research only capitalized positive business income and failed to take into account that 20% of pass-through wealth accrues to those with tax losses.

Portfolio Shares in Top Wealth Groups (2016) |

||||||

| Wealth Group | Fixed Income | C-Corp Equity | Pass-through Business | Housing | Pensions | Other |

| Panel A. Top Wealth Groups | ||||||

| Full population | 19.7% | 14.1% | 11.9% | 24.1% | 34.4% | -4.2% |

| Top 10% | 24.1% | 18.9% | 14.4% | 22.0% | 20.1% | 0.4% |

| Top 1% | 28.2% | 26.2% | 19.9% | 15.5% | 9.1% | 1.1% |

| Top 0.1% | 26.0% | 34.0% | 22.9% | 9.7% | 6.1% | 1.3% |

| Top 0.01% | 21.6% | 43.9% | 23.3% | 5.9% | 3.9% | 1.4% |

| Top 0.001% | 18.9% | 52.7% | 21.8% | 3.4% | 1.8% | 1.4% |

| Panel B. Intermediate Wealth Groups | ||||||

| Bottom 90% | 10.1% | 3.5% | 6.5% | 28.6% | 65.7% | -14.4% |

| Top 10-1% | 20.3% | 11.9% | 9.0% | 28.4% | 30.8% | -0.2% |

| Top 1-0.1% | 30.0% | 19.4% | 17.4% | 20.5% | 11.7% | 1.1% |

| Top 0.1-0.01% | 29.7% | 25.8% | 22.5% | 12.8% | 7.8% | 1.3% |

| Top 0.01-0.001% | 23.7% | 36.8% | 24.5% | 8.0% | 5.6% | 1.3% |

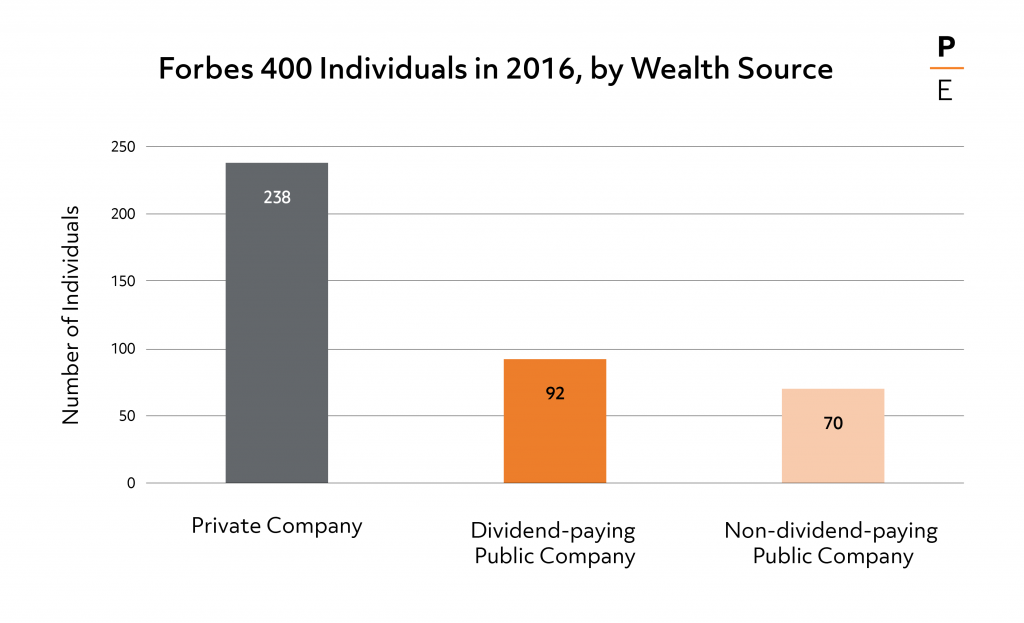

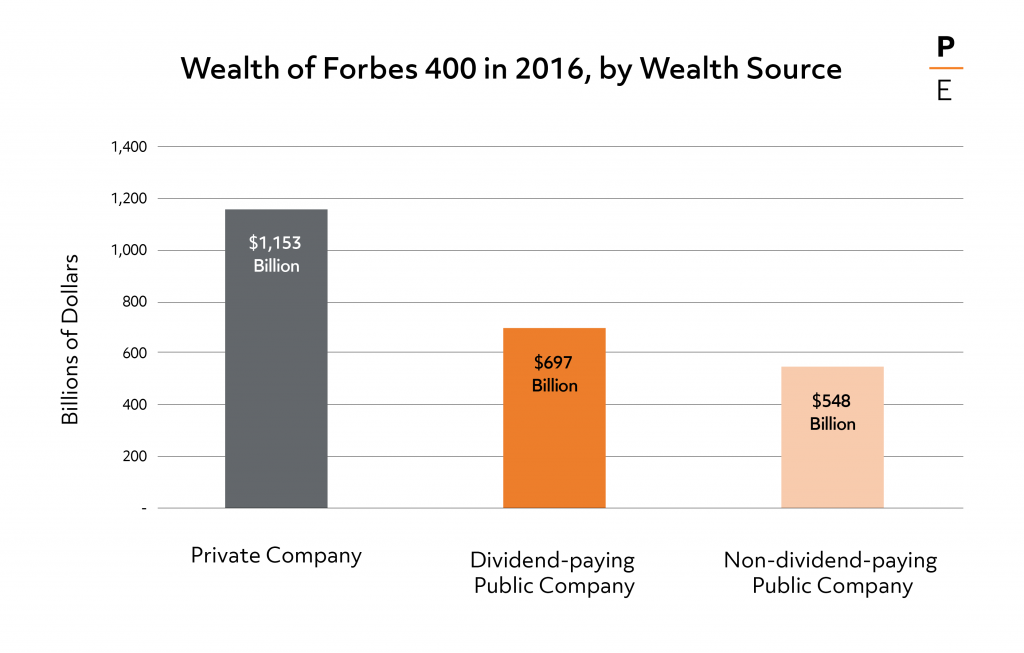

The authors show that the “private business rich”–many of whom accumulated their wealth by owning regional franchises, such as auto dealerships or beverage distributors, or running successful law or medical partnerships–account for substantial amounts of wealth at the top. Even at the very top, the private business rich represent more than half of the Forbes 400 list of the richest Americans, and account for nearly half of the collective wealth in the Forbes 400.

Policy implications

The work has many practical implications for policies to reduce inequality and more effectively raise revenue by taxing the rich.

Reforming tax breaks for pass-through businesses would increase tax revenue and tax progressivity. A closer look at the composition of U.S. wealth paints a different picture of the rich in America than is typically understood. Many of America’s ultra-wealthy are private business owners benefiting from tax benefits to pass-through business owners. Thus, reforms to overhaul tax breaks to pass-through businesses as well as efforts to repair tax enforcement weaknesses related to private businesses, and related loopholes, would increase tax progressivity substantially. Recent estimates of the tax rates that businesses pay show that pass-throughs pay historically low effective tax rates.

A wealth tax may raise less revenue than previously believed. Prominent wealth tax proposals focus on raising revenue from the extremely wealthy, but the new estimates show wealth is less concentrated among this group that previously believed. The authors’ estimates therefore reduce mechanical wealth tax revenue estimates.

Reforms that focus on payments to owners of businesses—the corporate tax, the dividend tax, and capital gains tax—provide established ways to increase tax progressivity. The largest component of wealth of the richest Americans is C-corporation equity wealth. Effective tax rates for each of these taxes have fallen substantially in recent decades. Consequently, reverting back to the tax code of 1997 would raise substantial tax revenue and increase tax progressivity. In addition, higher corporate tax rates and minimum taxes would likely increase tax payments from the wealthiest Americans.

Sign up to receive email alerts when we publish a new working paper.

Improving measurement of top wealth

The paper uses new data and methods to measure the rise and concentration of wealth in the United States. It’s main methodological contribution is to assemble new data that links people to their sources of capital income and then develop new methods to estimate different rates of return within asset classes that depend on an individual’s wealth.

The methods build on those first used by Saez and Zucman (2016), Piketty, Saez and Zucman extended (2018), and Bricker, Henriques and Hansen (2018). Appendix L describes how these estimates compare to this important prior work, and this document replies to prior comments from Saez and Zucman on this research.